Banks

In a recently published report, the Indian software company Infosys formulated the main theses on the prospects for the implementation of blocking solutions by banks business in 2017. The main theses from this report are published in the blog of our international wire-spin service Wirex.

- 50% of the banks surveyed either have already invested in the technology of blockhouses, or plan to do it In 2017.

- It is expected that in 2017 the average investment in block projects will amount to $ 1 million.

- 33% of respondents expect widespread sales of blockage in the commercial sphere in 2018, while most of them (50%) believe that this will happen in 2020.

- Most of the interviewed banks – about 69% – are experimenting with regulated blockhouses. A substantial proportion of players chosen and hybrid versions – 21%

.

- Cross-border payments, management of digital means of identification, clearing and settlement, processing of letters of credit and syndication of loans are the five main cases in which Blockboyne is most likely to receive the greatest commercial distribution.

- About 50% of the banks surveyed have chosen cooperation with financial start-ups or technology companies to build their capacity in the field of block-based solutions. Another 30% have chosen to participate in consortia.

- “Ecosystem readiness” and “lack of management models among stakeholders” were identified as two of the most serious difficulties on the way to large-scale application of technology.

- “Improved Transparency Between Counterparties” and “Reducing Time for Transactions and Settlements” were recognized as the two most significant advantages of technology.

- According to 74% of the banks surveyed, the engines of block projects are technical directors, innovation directors or business leaders.

Innovators, early supporters and observers

About 50% of the responding banks acknowledged that they wait until the technology reaches a more mature level of development. In the short term, these banks plan to work out limited scenarios for using the technology before allocating funds for larger investments.

Slightly more than a third (35%) of respondents fall into the category of “early supporters”. This includes financial institutions that have already identified the suits that are useful for themselves and suitable for their development strategy. They plan to invest in relevant initiatives in the near future. The range of financing projects in this category is from 1 to 10 million dollars.

The original “innovators” are players who have already launched a full-scale launch of blockbuster initiatives with the support Established internal teams or partners represented by technological start-ups and companies. In this category, about 15% of banks have fallen in.

Such players have already committed more than $ 10 million in funds to support initiatives and are engaged in experimental study of options for using blockage that go beyond traditional scenarios, such as cross-border transfers, clearing And mutual settlements. In an effort to take advantage of the pioneers, these banks have already taken the first steps in developing and developing solutions that have every chance to become one of the first full-fledged block-ecosystems in the industry.

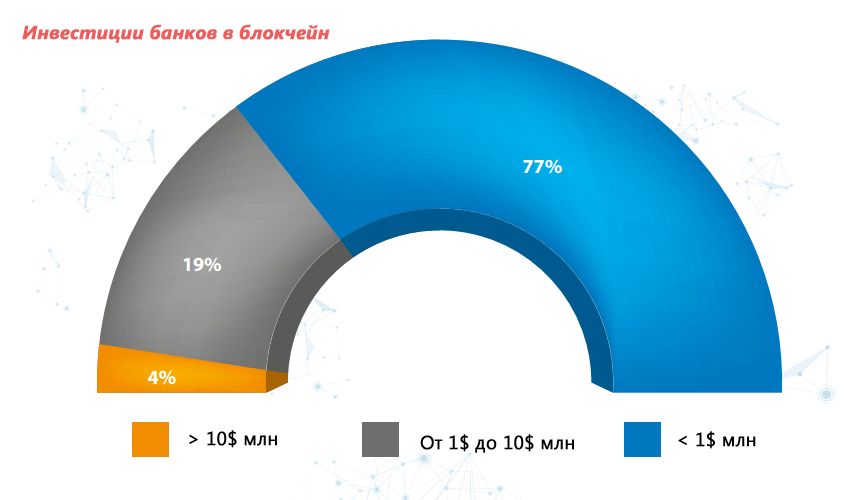

The expected growth of block investment in 2017

The size of investments of the majority (77%) of the banks-respondents is at the level of $ 1 million. At the same time, 4% of participants reported an investment of more than $ 10 million. Be that as it may, the share of this group will grow in the future, since the remaining 19% of participants who have allocated from 1 to 10 million dollars, are planning to increase funding for blocking initiatives.

Business leaders, technical directors and directors of innovation manage block-financing

The initiative on financing of block-projects in banks at the moment comes from representatives of different divisions. In most cases, the heads of technical departments and the director of innovation act as stakeholders, however, business unit managers are increasingly playing a key role in launching relevant projects. In 28% of the banks surveyed, technical directors are working on block projects, and in 23% of banks this role is taken over by the director for innovation. A variety of options for the application of technology also did not go unnoticed by the chiefs of business units. Thus, 21% of respondents indicated that such initiatives are under the control of business directors. Representatives of a small proportion of respondents (16%) also reported that their organization of blocking projects are overseen by CIOs, mainly because their activities are also closely related to the operation of business systems

Most of the banks (69%) choose the closed closed block model

The security of data and consumer transactions is a matter of paramount importance for financial institutions. The concept of open blockages is associated with security concerns, and therefore most banks use closed regulated blockhouses as a model that can reduce security risks. Closed lockers also offer greater flexibility, increased reliability and adaptability in comparison with the open block infrastructure.

69% of the banks interviewed reported using the closed block model. In addition to security concerns, this choice is due to the ambiguous situation with the regulatory approval of open blockrooms, since they do not provide the opportunity to conduct KYC checks and fulfill the requirements for combating money laundering, which in turn provokes operational risks.

About 21% of respondents either already use hybrid blockhouses or plan to use them in the near future.

Brief information

- An open detachment is a completely decentralized blockhouse. Anyone can join his work and participate in the process of reaching consensus.

- A hybrid block works as a consortium, where the process of consensus is controlled by some specific group of nodes.

- In a closed blockade, more stringent access control is applied, including by splitting the rights of reading and changing certain information.

image “/>

Cross-border payments, digital identification systems, clearing and mutual settlements are the most preferable scenarios for using block-application applications

Banks are studying various options for the use of technology in the field of financial services to both traditional and non-traditional. This survey confirms that the most preferable of them are those that reduce costs, simplify business processes and increase operational efficiency.

Cross-border payments, digital identity systems, clearing and mutual settlements, along with slightly less relevant cases, such as Crediting on the basis of payment documents and processing of letters of credit constitute the five most preferred scenarios for use.

Partnership agreements play key th role in the implementation of projects blokcheyn

Distributed technology platforms, such as block system, can achieve their true potential only with the support of business networks and partner groups. Therefore, it is not surprising that most of the responding banks reported participation in partnerships with technology firms, finteh companies, colleagues in the field of activity and central organizations aimed at developing block-application applications. The most preferred (49%) way of creating networks of partner partners is participation in already formed associations.

Some common Patterns of technology deployment on the market

According to the results of the survey, the majority of respondent banks (80%) expect that a full-scale and large-scale application of the detachment in the financial services industry will become possible closer to 2020.

The respondents consider cross-border payments to be the most ready for implementation case. They expect that the first solutions in this segment will be presented already this year.

Among other application scenarios, they also identified seven areas that, in their opinion, must have full-fledged block-applications. This includes documentary transactions, loan syndication, clearing and mutual settlements, digital identity, crediting on the basis of payment obligations and smart contracts.

However, the survey authors conclude that the first practical examples expected in 2017 Year, will not be large-scale or wide-ranging. In their opinion, they will not be able to feel the thoroughness of the block-innovation innovations before 2020.

Based on the survey data, they predict that in the next two years we will see the emergence of predominantly intra-bank blockbuster decisions, or interbank solutions for use within a network of partners in segments such as cross-border payments and digital identity. Further (2-5 years) will follow the period of appearance of other interbank decisions and cases involving regulators, in particular, in the segment of documentary operations. In subsequent years (5 years or more), we will witness a wider spread of Blockboys in the financial services and banking ecosystem.

The authors of the study also expect that by 2020 the spread of block-applications will reach a scale sufficient for their involvement Into larger ecosystems, involving the government and corporations from other industries and, possibly, even end-users.

Road ahead

Results of the study show that in the next two years Blokcheyn technology will be a major area of research for the banks. Today the main question is no longer whether they will be engaged in the practical implementation of Blockschine, but in when and how it will happen. In this respect, the authors of the survey identify two possible areas – internal and external.

Banks can begin mastering technology from internal cases that are inspected within their own infrastructure, in order to subsequently apply the accumulated experience of working with Blockchan in joint projects with industry partners. ]

From the point of view of the external direction of development, several banks have already begun to conduct relevant experiments in cooperation with technology partners, and also formed consortia.

Dal It follows a brief evaluation of the main stages of the practical spread of blockages in the coming years, provided by the authors of the survey.

2014-2016. Phase 1. Value analysis Block for the financial services industry

- Banks and financial intermediaries have formed industry groups to discuss opportunities.

- Creation of closed groups of industry representatives, as well as their technological and finteh partners.

- Creation of partner projects covering the entire industry, such as R3 and Linux Hyperledger Foundation.

2016-2018. Phase 2. Verification of the concept

- Search for key concepts that can have some impact on the business and assess the possibility of scaling blocking solutions to reduce costs while maintaining the required level of security.

- Dialogue between regulators, auditors, partners and the ecosystem in order to identify the most important and needing optimization processes that will benefit most from the introduction of technology.

- The purpose of test projects is to assess whether blocking processes provide any advantages in terms of performance, price, speed and scalability in comparison with existing processes.

- Despite the fact that some influential consortia have already been formed by 2017, in general, the issue of establishing a collective dialogue and joint agreements on universal and flexible open industry standards remains open.

- Governments and regulators will play an important role, which will consist in protecting consumers and at the same time encouraging innovation.

2019-2020 gg. Phase 3. The emergence of a joint infrastructure

Industry players will begin to introduce block-products that meet the needs of individual business areas.

Effective use of joint infrastructure, APIs and interfaces to expand the scope of the technology.

As Blockchane spreads, consolidation and standardization will become the norm.

Previously competing financial institutions are aware of the benefits of a single approach, such as accelerating trading processes and improving data management processes for business transactions.

2021-2025. Phase 4. Prosperity of the block network

- Completion of the formation and strengthening of the standards of interoperability and communication channels.